Julie Fedorchak Congresswoman | Official Website

Julie Fedorchak Congresswoman | Official Website

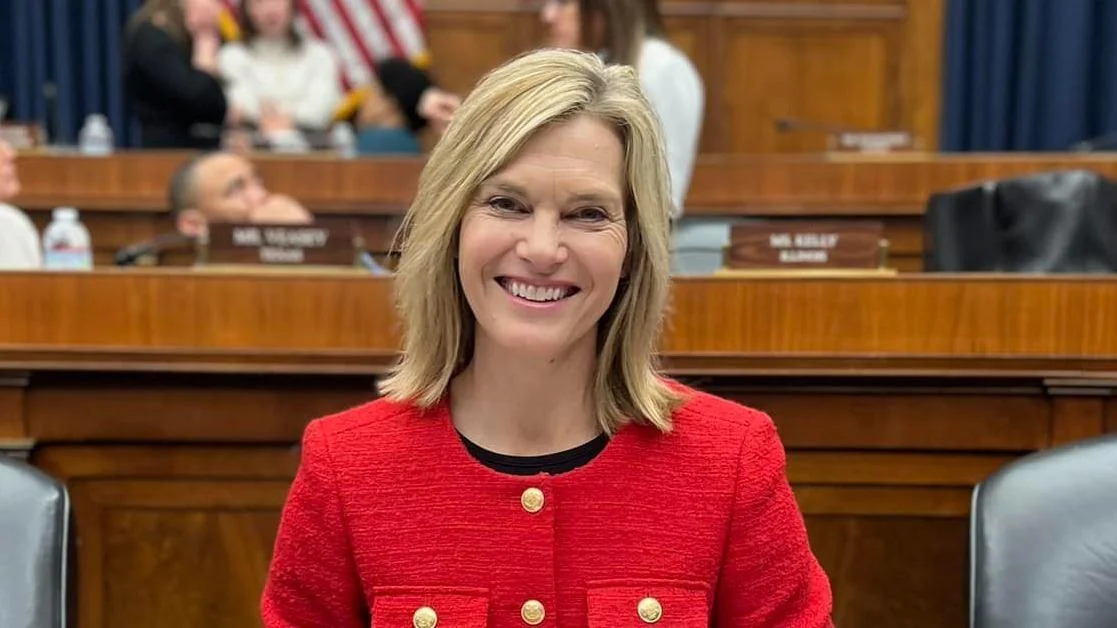

Congresswoman Julie Fedorchak has recently shared a series of policy proposals on her social media platform, focusing on tax reforms and savings incentives. These initiatives aim to alleviate financial burdens for various groups, including workers, families, and seniors.

On July 3, 2025, Congresswoman Fedorchak announced her proposal to "eliminate taxes on tips and overtime." This measure is intended to increase the take-home pay for employees who earn additional income through these channels.

In another post made on the same day, she outlined plans for "creating savings accounts for newborns," alongside efforts to enhance the Adoption Tax Credit and expand 529 savings accounts. These steps are aimed at providing long-term financial security from an early age and supporting families in planning for education expenses.

Additionally, Congresswoman Fedorchak proposed increasing the Child Tax Credit to $2,200 per child. She also introduced a new tax deduction initiative that would offer a $6,000 deduction for seniors receiving Social Security benefits with incomes below certain thresholds. According to her post from July 3rd, this would result in "zero taxes for 88% of seniors receiving benefits."

These proposals come amidst ongoing discussions about tax reform in Congress as lawmakers seek ways to address economic challenges faced by different segments of the population.

Alerts Sign-up

Alerts Sign-up